National Grid, a behemoth in the energy sector, has been a subject of fascination for investors and energy enthusiasts. In this article, we’ll explore the National Grid share price and dive into the dynamics that influence it. Let’s unravel the story behind this vital player in the energy industry.

Highlights

Understanding National Grid

Before we venture into the intricacies of the National Grid’s stock value, it’s essential to grasp the company’s identity. The National Grid Group plc, often referred to as National Grid, is a multinational electricity and gas utility company with operations in the United Kingdom and the United States. It plays a pivotal role in the transmission and distribution of electricity and gas, ensuring a steady energy supply.

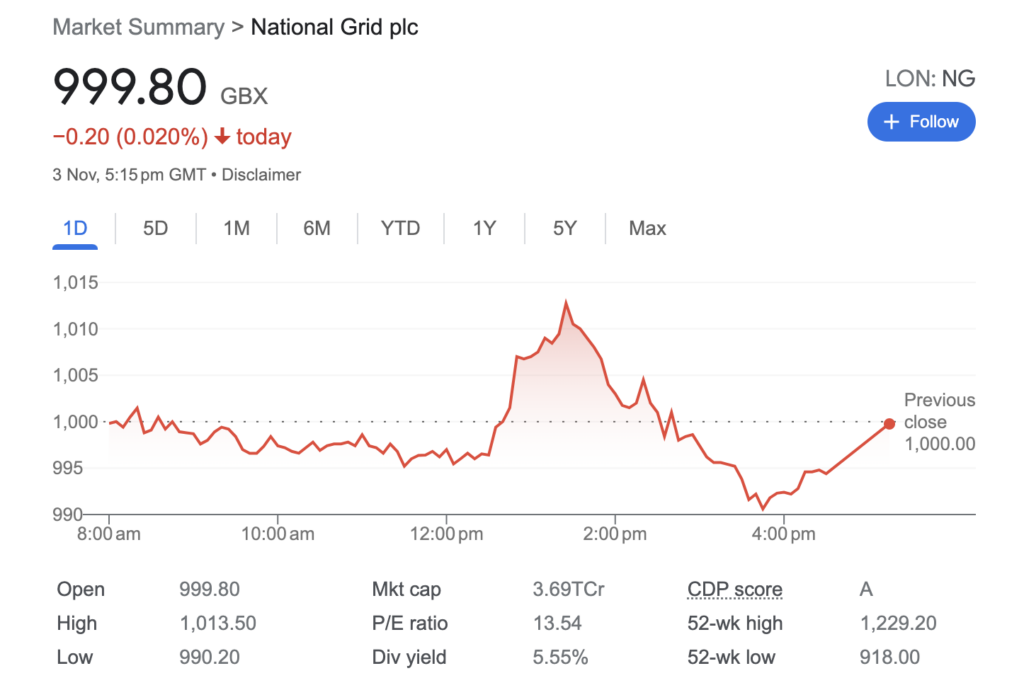

As of the most recent data available, National Grid’s share price is at a juncture of interest. Investors and industry experts are closely monitoring its movements. Here’s the present picture:

Recent Performance

National Grid’s share price has experienced fluctuations in recent times. To gain a comprehensive understanding, we must examine these trends.

Several key elements wield influence over National Grid’s share price. Let’s explore the most critical factors:

- Regulatory Environment: The energy sector is highly regulated. Changes in regulations, such as pricing mechanisms and environmental policies, can significantly impact National Grid’s financial performance and, consequently, its share price.

- Energy Demand: The level of energy demand, influenced by economic conditions and climate factors, plays a pivotal role in shaping the company’s outlook.

- Infrastructure Investments: National Grid’s investments in infrastructure development and maintenance have a direct impact on its operational efficiency and, consequently, its share price.

- Global Energy Trends: International energy trends, including shifts toward renewable energy sources and technological advancements, can alter the energy landscape and, in turn, affect National Grid.

Historical Performance

To gain a deeper insight into National Grid’s share price, we must assess its historical performance. By analyzing past trends, we can discern patterns and potential future movements.

Prospects and Future Predictions

It’s important to note that predicting stock prices is an inherently uncertain endeavor. Investment decisions should be grounded in thorough research and a well-considered strategy. Consulting with financial experts and staying informed about market developments is essential for making informed choices.

In conclusion, the National Grid share price remains a captivating topic for investors and energy enthusiasts. It mirrors the dynamics of the energy sector and is influenced by a variety of factors. Staying informed and monitoring market trends is crucial for investors looking to make well-informed decisions. Whether you’re a seasoned investor or a newcomer to the world of stocks, understanding the National Grid’s share price dynamics is an invaluable asset in navigating the ever-evolving energy landscape. Click the link to learn more

Leave a Reply